Featured Post

Get What Unsecured Credit Card Is The Easiest To Get Images

- Get link

- X

- Other Apps

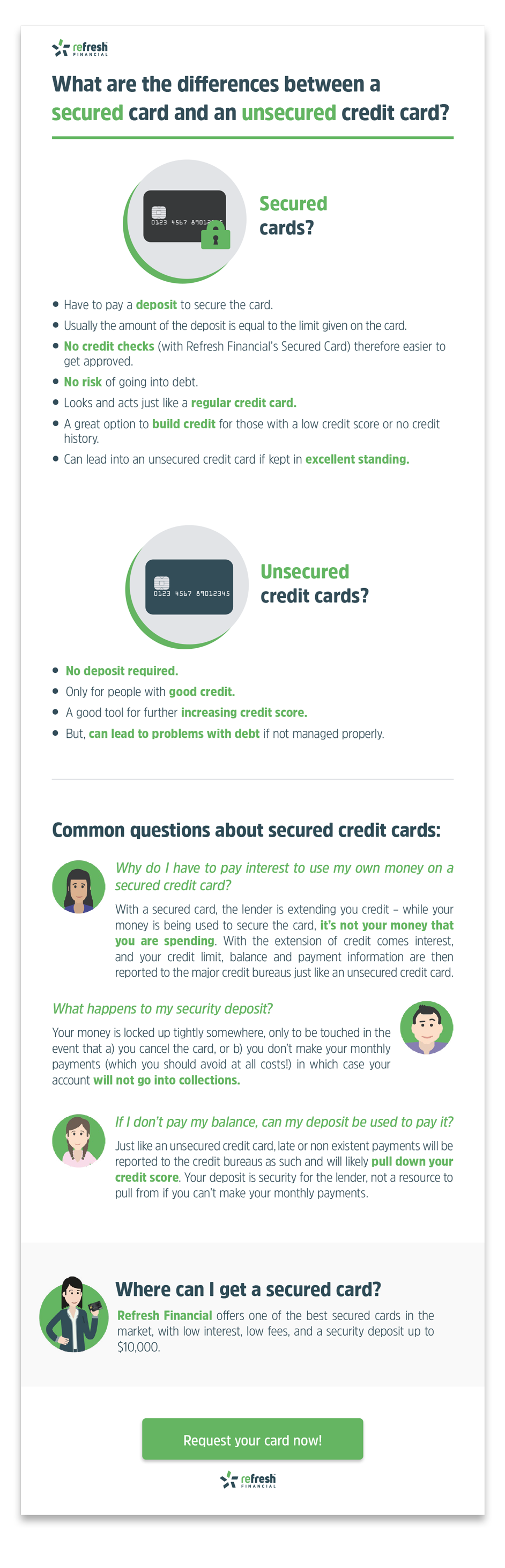

Get What Unsecured Credit Card Is The Easiest To Get Images. You can get an unsecured credit card by paying all your bills on time including rent or mortgage, utilities, auto loans etc. Some unsecured credit cards advertise themselves as easy to qualify for even if you have bad credit.

Annual fees are the easiest to spot, but there are others.

But these cards usually charge extremely high fees. For this reason, unsecured credit card issuers are more selective during the application process, and it can be more difficult for an aspiring cardholder to get that's because card issuers prefer applicants who have established a credit history of repaying loans on time and as promised. And it's usually refundable—you might get it back if you pay your balance in full and close. You can have a limit of anywhere from $300 to $5,000 with a us bank secured visa.

- Get link

- X

- Other Apps

Comments

Post a Comment